Navigate Your Medicare Choices: Medicare Supplement Plans Near Me

Navigate Your Medicare Choices: Medicare Supplement Plans Near Me

Blog Article

How Medicare Supplement Can Enhance Your Insurance Coverage Today

As people browse the ins and outs of healthcare plans and seek comprehensive defense, comprehending the subtleties of supplemental insurance ends up being progressively vital. With a focus on connecting the gaps left by conventional Medicare plans, these supplementary alternatives provide a tailored method to meeting details requirements.

The Essentials of Medicare Supplements

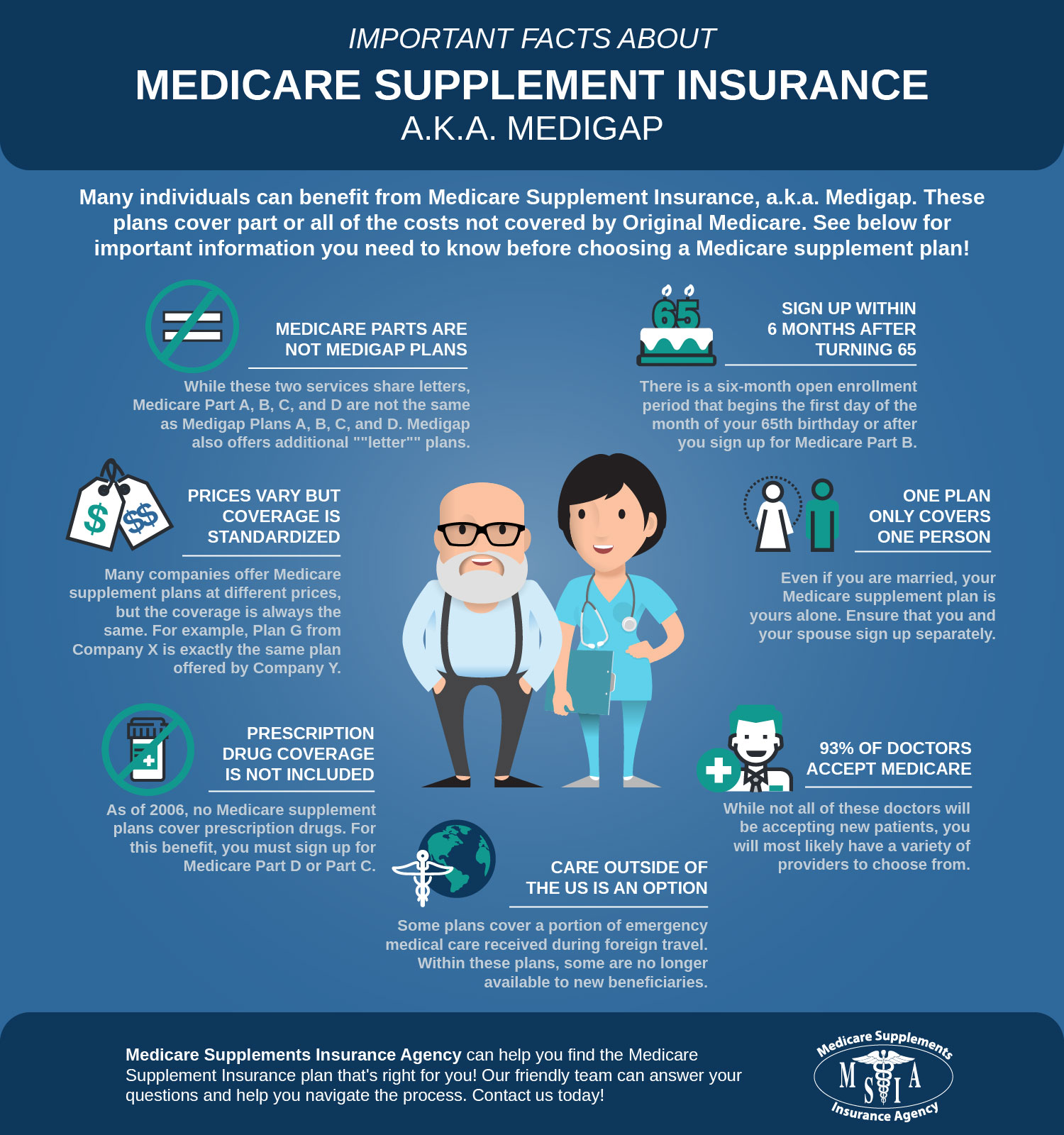

Medicare supplements, also known as Medigap plans, supply additional insurance coverage to fill up the voids left by initial Medicare. These auxiliary strategies are used by private insurer and are created to cover expenses such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Component A and Part B. It's vital to keep in mind that Medigap strategies can not be made use of as standalone policies however work together with initial Medicare.

One trick aspect of Medicare supplements is that they are standard throughout many states, providing the very same basic advantages no matter of the insurance policy supplier. There are 10 different Medigap plans identified A through N, each supplying a different level of insurance coverage. Strategy F is one of the most comprehensive choices, covering nearly all out-of-pocket expenses, while other strategies may offer extra minimal insurance coverage at a reduced costs.

Comprehending the fundamentals of Medicare supplements is crucial for people approaching Medicare eligibility who wish to improve their insurance protection and reduce prospective monetary burdens related to health care expenses.

Recognizing Insurance Coverage Options

When considering Medicare Supplement plans, it is critical to comprehend the various insurance coverage alternatives to guarantee extensive insurance protection. Medicare Supplement intends, also known as Medigap policies, are standard throughout many states and classified with letters from A to N, each offering differing levels of protection - Medicare Supplement plans near me. In addition, some plans may use insurance coverage for solutions not included in Initial Medicare, such as emergency care during foreign travel.

Advantages of Supplemental Program

Furthermore, additional strategies provide a more comprehensive array of coverage choices, including accessibility to health care service providers that may not accept Medicare task. One more advantage of additional strategies is the ability to travel with peace of mind, as some strategies supply insurance coverage for emergency situation clinical solutions while abroad. Generally, the advantages of extra strategies contribute to a more extensive and tailored strategy to healthcare protection, ensuring that people can receive the care they require without dealing with overwhelming financial burdens.

Expense Considerations and Savings

Provided the monetary security and wider protection options given by extra plans, an important facet to take into consideration is the expense considerations and prospective savings they offer. While Medicare Supplement intends need a month-to-month premium along with the conventional Medicare Part B premium, the advantages of reduced out-of-pocket expenses usually surpass the added expenditure. When assessing the price of additional strategies, it is vital to compare costs, deductibles, copayments, and coinsurance throughout different strategy kinds to establish the most economical alternative based upon individual medical care needs.

By choosing a Medicare Supplement plan that covers a higher percent of health care expenses, find more information people can reduce unforeseen expenses and spending plan a lot more effectively for medical care. Ultimately, spending in a Medicare Supplement strategy can provide beneficial economic security and tranquility of mind for beneficiaries looking for thorough insurance coverage.

Making the Right Selection

Choosing the most suitable Medicare Supplement strategy demands cautious consideration of individual healthcare needs and economic scenarios. With a selection of plans available, it is essential to assess elements such as protection alternatives, costs, out-of-pocket costs, service provider networks, and general worth. Recognizing your present health and wellness standing and any type of expected medical requirements can direct you in selecting a strategy that provides comprehensive insurance coverage for solutions you might call for. Furthermore, evaluating your budget restraints and contrasting premium expenses among different plans can help guarantee that you choose a plan that is budget friendly in the long-term.

Conclusion

Report this page